How to open a company in Georgia and a corporate account in the bank of Puerto Rico without visiting other countries

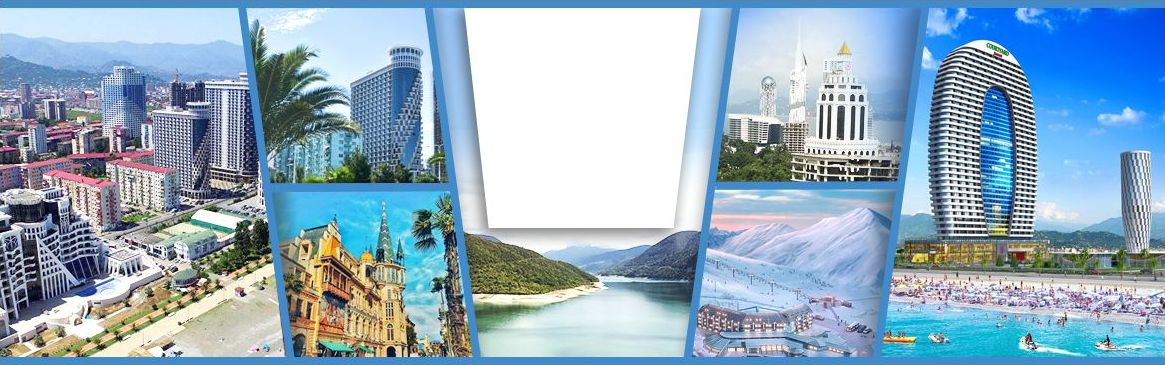

Having heard the word “Georgia”, most of us immediately imagine mountains, the Black Sea, wine, hachapuri, and hospitable people in their minds. This all, together with historic monuments and beautiful nature, attracts tourists from around the world. Thus, during July of 2019 Georgia was visited by 1,099 million of foreigners, which is 5,8% more than for a similar period of last year. Analysts forecast that during 2019 the number of tourist will as minimum remain at the level of 2018, which is 8,7 million people. Nevertheless, not everyone comes to Georgia for a vacation; this country also fascinates foreign businessmen. Considering an option of registering a company in Georgia in 2019 is more than reasonable. The Georgian jurisdiction is especially attractive from the point of: decreased fiscal burden, available cheap working force, great transit potential, and low bank commissions. All these in aggregate, as well as absence of the country among participants of automatic exchange of financial information, makes it reasonable to register an entity in Georgia for non-residents who work in the sphere of IT, international trade, transportation and logistics, and production.

To diversify risks related to bank services, especially after events in Baltic countries, and to increase the quality of payments to counteragents, the company Offshore Pro Group recommends to open a corporate account in the bank of Puerto Rico. This instrument will provide you the access to the US financial system, as the bank has its account in the Federal Reserve System.

A company can be registered in Georgia, and a corporate account can be opened in the bank of Puerto Rico online with the help of Offshore Pro Group, without visiting these states. Upon request, we may organize meeting with a bank employee. The price of package offer is 6 950 EUR, provided that all shareholders of a company are natural persons. Whether legal entities are among founders (which rarely happens), then the price of the offer increases up to 7 950 EUR.

Why should we open a company in Georgia?

For the last decade, Georgia has come a difficult way of reformation. Significant changes occurred in the tax system, administration, and security bodies. As result, in 2018 Georgia entered the TOP-10 countries by simplicity of making business under the data if the World Bank, by level of loyalty of fiscal system on it is on the 16th place (rating Paying Taxes 2019), and by level of safety on the 17th place in the rating “Global law and order 2018”, which are the best indexes in the region.

What are the benefits of establishing a company in Georgia?

The first that attracts foreign businessmen who wish to open a company in Georgia is the real possibility of decreasing the tax burden. In Georgia, with the purpose to attract investments from abroad, special Free industrial zones (FIZ) were established. In these territories companies that export their products abroad are exempted from taxes and from submitting the tax reporting. This greatly simplifies making business and reduces costs, even with account of opening a new company in other country.

For comparison, a standard company in Georgia has the following obligations to the state budget:

- 15% — corporate tax on income, is not paid where a profit is not distributed and is further used for development of business;

- 18% — VAT;

- up to 1% — tax on property;

- 0%, 5% or 12% — tax on import; the rate depends on the type of imported goods.

Besides, VAT is not applied (18%) in the territory of FIZ Georgia, due to which electric energy and other services here are cheaper. The focus on cheap electric energy (customer fee from 301 kWh – 22,733 tetri or approx. 7,7 cents) is made because the low cost of energy, as well as absence of fiscal obligations, complete freedom of currency payments, low bank commissions and high quality of service are the factors that help FIZ attracting legal entities operating in the sphere of cryptocurrency mining. Moreover, as for the last factor, small Georgia is one of the world leaders; in 2017 it was only second to China by amounts of crypto mining worldwide.

Opening IT company in Georgia – tax benefits

The same attractive tax conditions were provided for IT companies. A non-resident may open in Georgia a company that deals with development of mobile applications, games, software, or works in other spheres of IT, due to a possibility of decreasing tax burden with benefits. IT companies may just in a few days obtain a status of a “virtual person” in Georgia, which exempts them from any obligations to the state budget, except tax on payment of dividends (5%). Considering that in Georgia cost of bank service is quite low and currency control is absent, it becomes even more advantageous for a non-resident to register IT company in this country.

Learn more about benefits of making business through IT company in Georgia with account in Bank of Georgia.

Other reasons for non-residents to register companies in Georgia

Except a loyal tax system and possibility of reducing tax costs, non-residents are interested in Georgia due to a number of other factors:

- simplicity and easiness of registration of a legal entity or a sole proprietor – all registration procedures and registration as a taxpayer is made in the Houses of Justice in 1 working day;

- no legislative limitations on the amount of the authorized capital, citizenship of shareholders; the only hardships that non-residents may face are completing documents in Georgian language and verification of the legal address of the company;

- concluded agreements on free trade with China, Hong Kong, EU, EFTA, CIS, and Turkey, which provide a duty-free access to products of Georgian manufacturers marked with “Made in Georgia”;

- absence of visa limitations for citizens of more than 90 countries of the world – they all may stay in the territory of Georgia up to 1 year without obtaining a visa;

Learn everything about obtaining visa in Georgia.

- favorable geographic location and transit potential – Georgia is the “sea gates” for neighbor countries without exit to the sea, as well as for China and countries of the Persian Gulf. Manufacturers of these countries are actively using Georgian sea ports to deliver their products in Europe. It should be noted that amounts of transfer by all means of transport within the territory of Georgia keep growing;

- availability of cheap working force – the average salary in Georgia does not exceed 300 USD.

As result, it becomes economically viable to open a company in Georgia that will be operating in the sphere of: trade, transfer, logistics, and production, at the same time being focused on export of products in countries of Europe, China, and CIS. Here it is possible to obtain definite economy on payment of taxes, salary, and expenses on utilities, bank and other services.

Why would a Georgia company need a corporate account in the bank of Puerto Rico?

Offshore Pro Group helps not only to register business in Georgia, but also to open a corporate account in the bank of Puerto Rico remotely. Let us remind that Puerto Rico is the country set on becoming the 51 state of the USA. It is located in the Caribbean Sea on the namesake island not far from Cuba.

The wish to enter the United States of America resulted in today’s complete integration of the financial system of Puerto Rico into the bank system of the USA. In other words, a Georgian company after opening an account here automatically obtains the access to all services and options provided by the Federal Reserve System.

It is reasonable to open a corporate account in the bank of Puerto Rico for companies that deal with international trade, provision of IT services, and those experiencing troubles after termination of service by banks of Lithuania, Latvia, Estonia and Cyprus. Using this account, it is possible to diversify cash flows, increase flexibility of payments to international counteragents, and increase the level of confidentiality of your finances.

The bank of Puerto Rico has correspondent relations with Bank of America and Central Bank of America. Here Georgian companies may open a corporate account in euro with a unique IBAN, as well as accounts in dollars and sterling. The basic fee for opening an account is 2 500 USD. Also, users of corporate accounts bear the following expenses:

- for incoming payments – 0,6%-2,5%;

- for outgoing transfers – 60 USD.

The bank performs transfers through international systems SWIFT, SEPA and Fedwire.

For businessmen, the benefit is that the bank does not set limits on international payments. Still, it should be noted that the financial institution does not perform operations with cryptocurrency and neither withdraws cash from stock exchanges.

An advantage of the Puerto Rico bank is the great experience of cooperating with companies that work in the sphere of IT and trade. Besides, the financial institution specializes in issuance of bills of credit.

How to register a company in Georgia online with a corporate account in the bank of Puerto Rico

The procedure of registration of a legal entity in the Georgian jurisdiction and opening an account in the bank of Puerto Rico is very simple. To obtain this useful instrument for global trade, you need to do the following:

- Contact us at: info@offshore-pro.info.

- Agree with our expert upon terms of cooperation and tell him your wishes regarding business in Georgia.

- Pay the price of the package offer. Transfer can be made via any means: Webmoney, PayPal, WesternUnion, bank transfer, etc.

- Agree with our lawyer the text of the power of attorney.

- Notarize the power of attorney, copy of international passport, other documents (if necessary), and send them to us in Georgia.

- We prepare all constitutive documents, and our authorized employee will establish a company in Georgia.

- We prepare all documents for opening a corporate account in the bank of Puerto Rico.

- Upon completion of all procedures, we send customer documents for a Georgian company: articles of association, protocol of shareholders’ meetings, statement from the register of legal entities, agreements on opening of account and devices for remote control and passwords.

List of documents from non-residents necessary for provision of services

To obtain the package offer, a non-resident should provide an international passport and documents certifying the place of residence (purchase and sale agreements, rental agreements, utility bills).

Legal entities need to provide a wider set of documents: articles of association, protocol of shareholders’ meetings, statement from the register of legal entities, decree on assignment of director, international passports and documents certifying the places of residence of managers and founders of the company.

It should be mentioned that presented documents must be translated into English and apostilized.

If you need an effective instrument to make business on a global level, a Georgian company with an account in the bank of Puerto Rico will be just the right option. Please contact us right now: info@offshore-pro.info, and we will get back to you soon to discuss the terms of mutually beneficial cooperation.

Tags: #Companies in Georgia